GST reform in India 2025.

States voiced their opinions on the proposal to change tax rates, but ultimately agree. It was for the benefit of the average person. According to Finance Minister Nirmala Sitharaman. This argument helped the GST Council meet and reach a unanimous decision.

In an effort to highlight the cooperative federalism spirit. Union Finance Minister Nirmala Sitharaman wrote to the finance ministers of every state to thank them for their active participation and support in putting the historic reform of the goods and services tax (GST) regime into effect.

According to Ms. Sitharaman, who spoke to PTI. She debated the idea of changing tax rates but ultimately decided that it was in the best interests of the average citizen. This argument helped the GST Council come to a unanimous decision earlier this week.

At a September 3 GST Council meeting, approves the reform. It will result in lower prices for a broad range of goods starting on September 22. Including butter, chocolates, shampoos, tractors, and air conditioners.

What does it mean that the GST has changed?

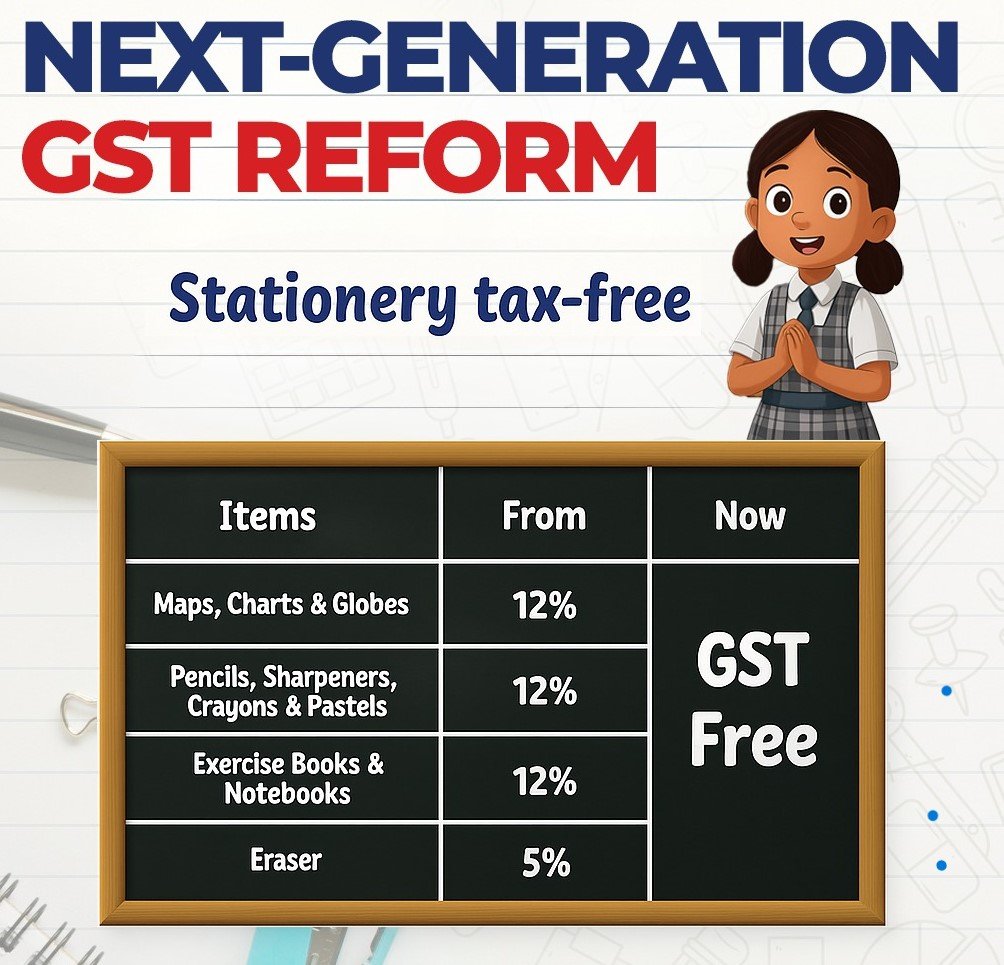

The GST Council has lowered rates for study materials, vehicles, healthcare, necessities, and agriculture in favor of a more straightforward two-rate structure. Luxury cars, large bikes, and high-end apparel may cost more. Everyday items, farm equipment, and insurance become more affordable. What impact does this have on the Center’s finances and state revenues?

All States and Union Territories are represented on the panel, which is chaired by Ms. Sitharaman.

“You can have as many heated discussions and arguments as you like. In the end, the Council steps up and provides relief to the Indian people, to all Indians.” I wrote a letter to each Finance Minister yesterday, thanking them. And for that gesture, I am thankful. “I wrote that letter,” she said.

Nirmala Sitharaman on GST reforms.

She describes the Council’s work as genuinely “remarkable.” The GST Council unanimously decides to restructure the GST despite concerns about the potential revenue loss from removing the 12% and 28% slabs and classifying the majority of products into two categories. 5% for common-use goods and 18% for everything else.

The panel is supposed to meet for two days beginning on September 3 to discuss the Center’s proposal. After a long day of meetings, they decide to approve it on the first day.

The general consensus in the house was that this proposal would definitely help the average person. Standing up to it is pointless. In the end, everyone united for a worthy cause, and for that. I am sincerely appreciative,” Ms. Sitharaman stated.

According to the Minister, states have always supported rate reductions and are only worried about the impact on revenue after tax cuts.

“Please, I begged them, for the benefit of the Indian people. It’s not limited to the United States. The reduction will even have an impact on the Center. However, we’ll compensate because the revenue impact will resolve. When people come out to buy, once the rates are reduced. Consensus was reached in this manner,” she said.

Speaking to a press conference after the GST Council meeting, Ms. Sitharaman thanked the States for their collaboration and teamwork in putting one of India’s biggest tax reforms into effect.

Nirmala Sitharaman news on GST update.

She states that every comment and suggestion made by its members had been patiently heard by the Council on Saturday, September 6, 2025.

She also emphasizes the inclusive character of the talks. Noting that a number of Ministers are given the chance to speak again after their initial points have been discussed.

The Finance Minister emphasized that “their additional inputs were heard and taken into account.” She also gives the States credit for their dedication to advancing tax reform and their positive involvement in the GST Council.

Updated Goods and Services Tax (GST).

New GST rates will take effect on September 22, 2025, with the exception of cigarettes and tobacco products.